2024 Federal Income Tax Brackets And Rates

-

admin

- 0

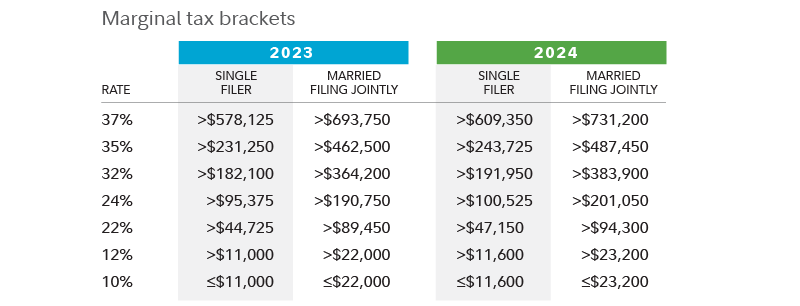

2024 Federal Income Tax Brackets And Rates – There are seven federal income tax rates for 2023 and 2024: 10%, 12%, 22%, 24%, 32%, 35% and 37%, depending on your taxable income and filing status. . With the new year comes new beginnings … such as the start of a new tax year. And with a new tax year comes new opportunities to plan ahead for the income and expenses that will be reported on your .

2024 Federal Income Tax Brackets And Rates

Source : www.financialsamurai.com

Kick Start Your Tax Planning For 2024

Source : www.benefitandfinancial.com

Tax brackets 2024| Planning for tax cuts | Fidelity

Source : www.fidelity.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

Bloomberg Tax Archives CPA Practice Advisor

Source : www.cpapracticeadvisor.com

Tax Brackets & Federal Income Tax Rates 2023 2024 | TIME Stamped

Source : time.com

2023 2024 Tax Brackets and Federal Income Tax Rates | Bankrate

Source : www.bankrate.com

Tax Foundation on X: “The #IRS released its new #inflation

Source : twitter.com

Federal Income Tax Brackets for Tax Year 2024 | SmartAsset

Source : smartasset.com

2023 2024 Tax Brackets & Federal Income Tax Rates – Forbes Advisor

Source : www.forbes.com

2024 Federal Income Tax Brackets And Rates 2024 Income Tax Brackets And The New Ideal Income Financial Samurai: For both 2023 and 2024, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Below, CNBC Select breaks down the updated tax brackets of 2024 and what you need to know. . each layer gets taxed at progressively higher rates. A single person with $140,000 in taxable income in 2024 would be in the 24% tax bracket. This doesn’t mean all of their income is taxed at .