Economic Relief For 2024 Social Security Tax

-

admin

- 0

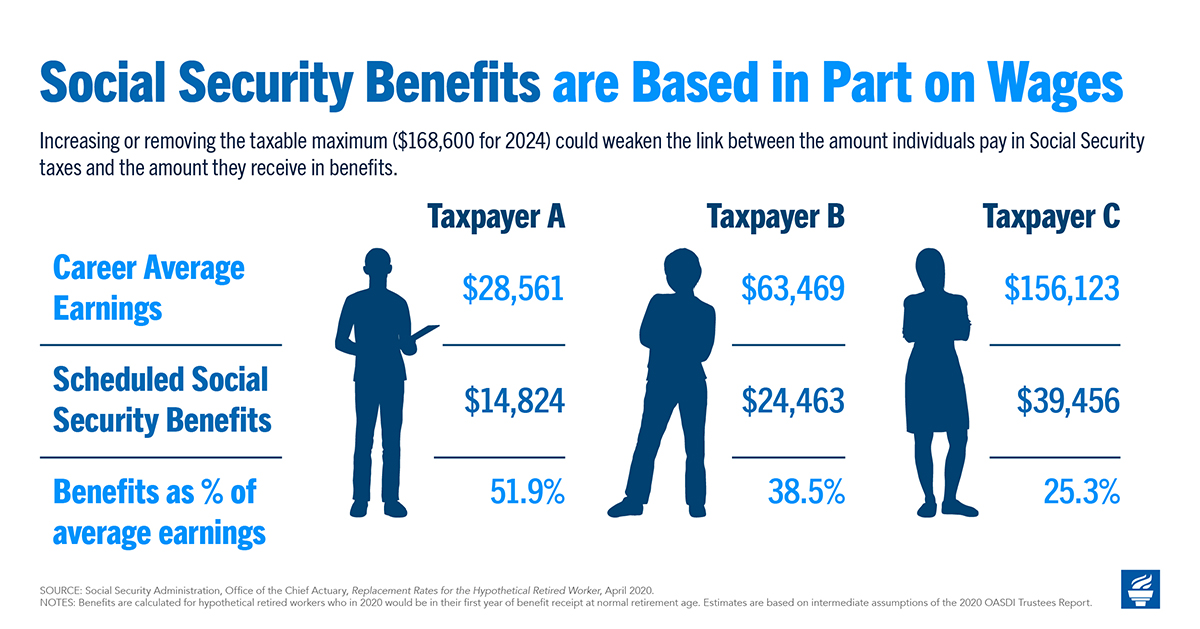

Economic Relief For 2024 Social Security Tax – If you depend on Social Security for all or most of your retirement income, you’re not in a good position — but you’re hardly the only one. “According to the U.S. Census Bureau, poverty among . If you’re self-employed, you pay both halves of that tax. In 2023, the salary limit subject to Social Security tax is $160,200. In 2024 can help provide some relief, at least until you .

Economic Relief For 2024 Social Security Tax

Source : www.pgpf.org

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

Should We Eliminate the Social Security Tax Cap? Here Are the Pros

Source : www.pgpf.org

Eric J. Konopka, MBA, Financial Advisor

Source : m.facebook.com

Joe Wilson on X: “On the next stop of my Legislative Agenda Tour

Source : twitter.com

Social Security COLA to Give Retirees a 3.2% Raise in 2024 WSJ

Source : www.wsj.com

Should We Eliminate the Social Security Tax Cap? Here Are the Pros

Source : www.pgpf.org

Edward Jones Financial Advisor: Scott Hoagburg | Airway Heights WA

Source : www.facebook.com

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

Sylvia Ang, Licensed Agent with New York Life

Source : www.facebook.com

Economic Relief For 2024 Social Security Tax Should We Eliminate the Social Security Tax Cap? Here Are the Pros : As seniors navigate these economic challenges will likely pay taxes on their benefits in 2024 because of a significant COLA increase in 2023. “Up to 85% of Social Security benefits can . A dozen states imposed taxes that now that 2024 has begun, residents in a pair of states that were among those who got taxed on their Social Security can breathe a sigh of relief. .